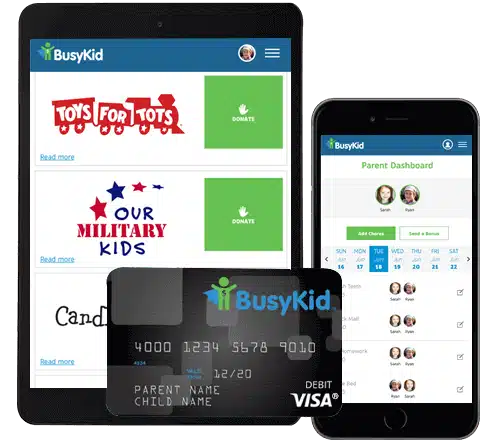

You want your kids to do their chores, but let’s be honest, you also want your kids to be able to make the most out of their allowance. That is why we have created the ONLY Chore Chart App that allows your kids to get experience INVESTING IN REAL STOCK and DONATING TO CHARITIES by utilizing the allowance they earned through chores. BusyKid also makes it easy for your kids to learn THE IMPORTANCE OF SAVING and RESPONSIBLE SPENDING, and adopt these essential routines all while still under your watchful eye and guidance.

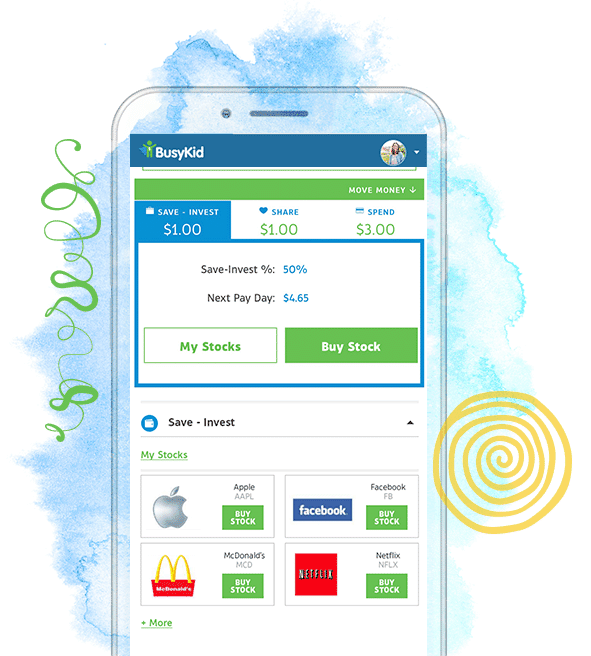

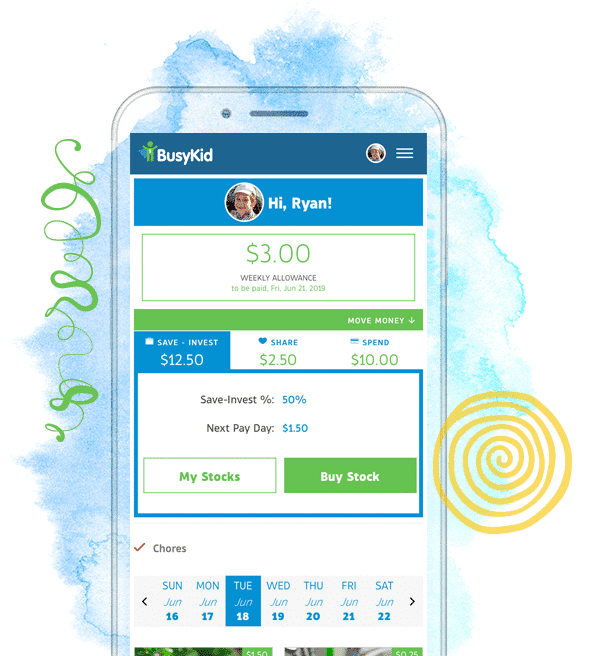

Do you want your kids to learn how to navigate the stock market? BusyKid is THE ONLY APP that makes it easy for your kids to take a percentage of their weekly allowance and turn it into real stock.

Any companies shown are not recommendations or solicitations to invest.

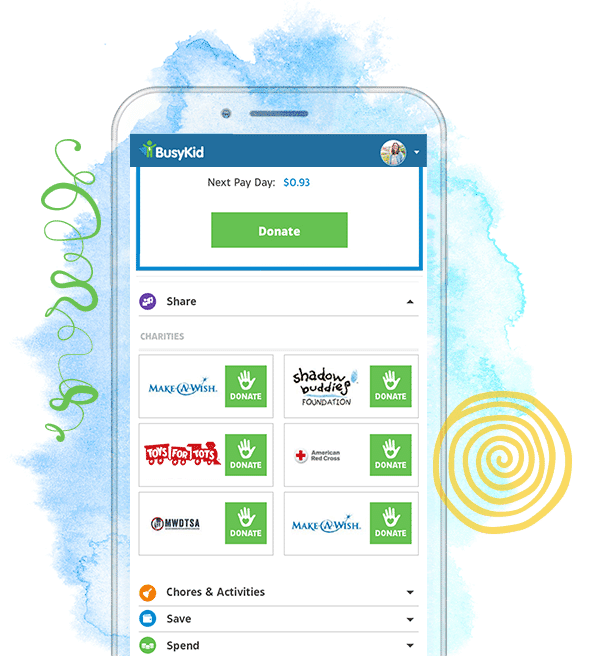

It is never too early for your children to learn the importance of giving back and finding a cause to support. BusyKid is THE ONLY APP that makes it easy for your children to take their first steps as donors allowing you to set a preset percentage of their allowance to go to their charity of choice.

Did you know that 39% of Americans admit to having no savings and over 50% admit to having less than $1,000 saved? BusyKid offers a streamlined process to automatically set a percentage of your kids’ allowance aside into a savings account, starting their safety net as early as five years old.

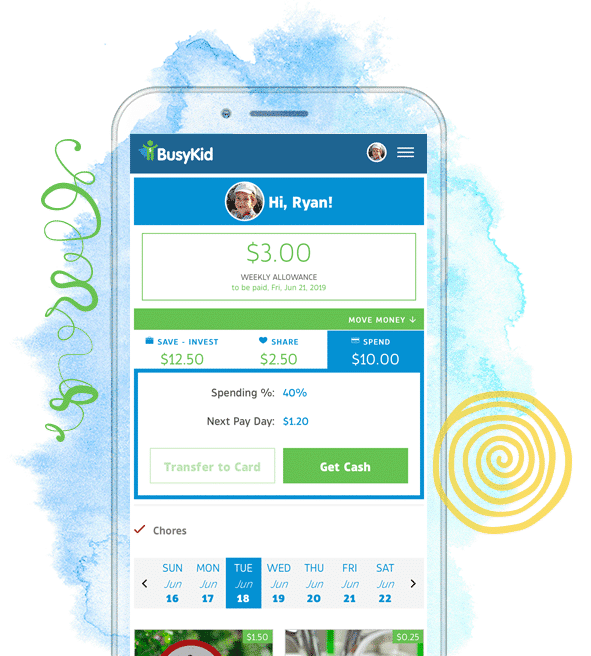

At the end of the day, your kids want to be able to spend their hard-earned money. BusyKid gives you an easy platform where you can sit down with your kids and develop responsible, budget-keeping spending habits right off the bat. You can also add the VISA® Prepaid Spend Debit Card to give your kids even more spending freedom.

Help & Support

COPYRIGHT © 2024 BusyKid®

* BusyKid Debit Card is issued by MVB Bank, Inc, pursuant to a license from Visa® USA Inc. Cliq® is registered ISO/MSP of MVB Bank, Inc.

For more information about your card terms and conditions including the VISA Zero Liability policy go here. Cliq® is registered ISO/MSP of MVB Bank, Inc.

Brokerage services provided by Apex Clearing, an SEC-registered broker-dealer and member of FINRA /SIPC.

Investments in securities: No Bank Guarantee • May Lose Value. Investing in securities involves risks, and there is always the potential of losing money when you invest in securities. Before investing, consider your investment objectives, charges and expenses. For more details, see our Form CRS, Broker Check and other disclosures.

*BusyKid can not refund any stock purchases made. There is no transaction fee when a bank account is used