So Much More Than A Chore App!

BusyKid’s features help your kids gain valuable hands-on experience for managing money.

Our app is easy to use and will motivate your children to save, share, and spend their allowance. They can even learn about investing from inside the app.

So MUCH, For So Little

For The Whole Family

EASY PRICINGWatch your kids and teens change the way they think about money and help around your home.

BusyKid is designed to provide your kids with real life lessons in managing money. For about $4/mo. (billed annually), your kids and teens will stop fighting over chores and will become motivated, accountable, responsible and money smart!

Every Subscription Comes With Five BusyKid Spend Cards

The BusyKid Visa Spend Card gives anyone between 5-17 years old the freedom to spend anywhere Visa is accepted, and parents see every transaction made. Instantly transfer funds anytime and anywhere. Up to 5 BusyKid Spend Cards are included in your family subscription, so there’s no reason why kids and teens can’t learn how to spend smart.

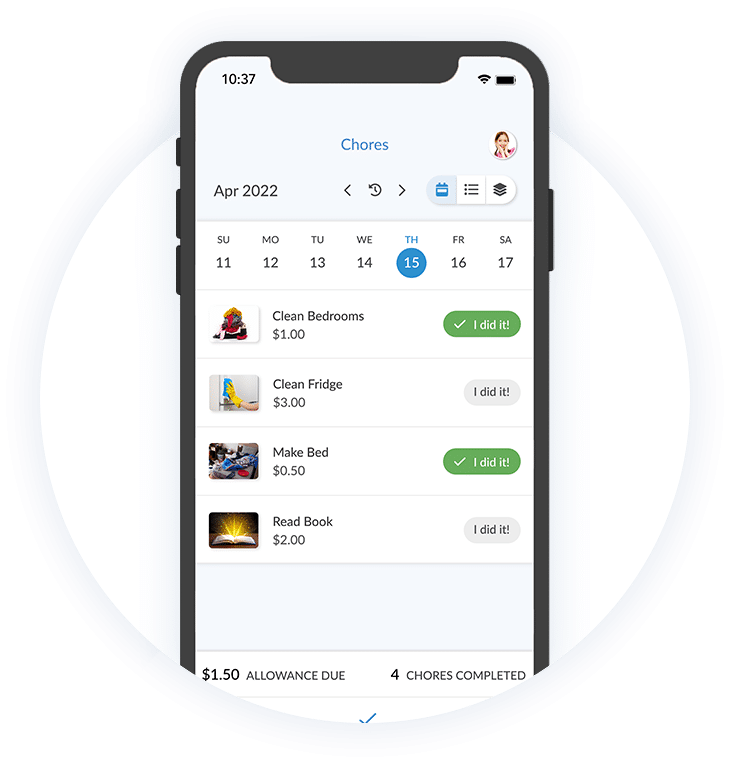

Chores & Allowance

(Set By Age)

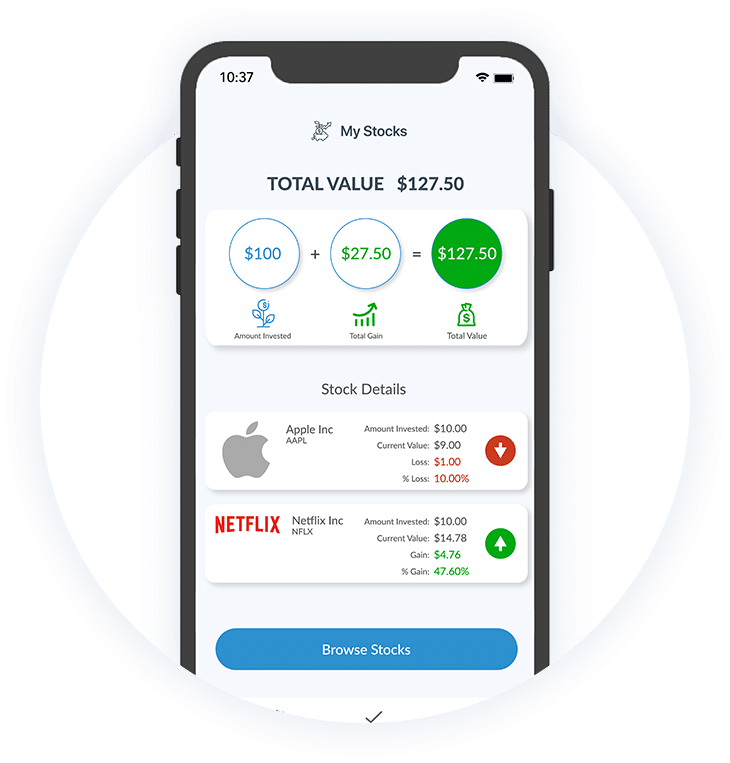

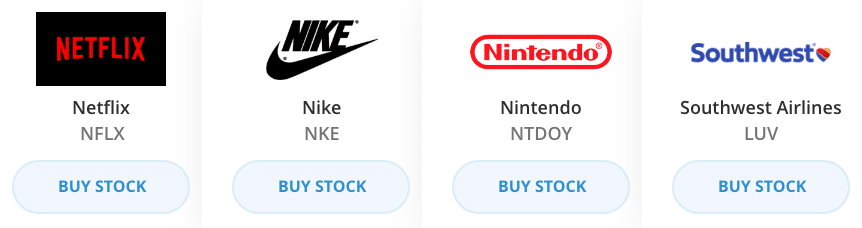

Experience Investing

There are no commissions for stock transactions.

Disclaimer: Any companies shown are not recommendations or solicitations to invest.

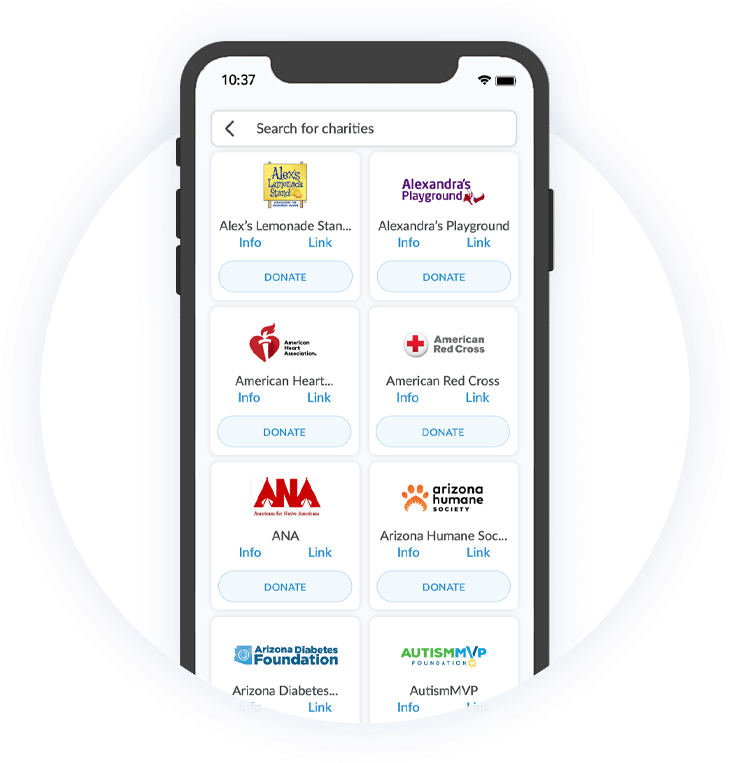

Charities To Support

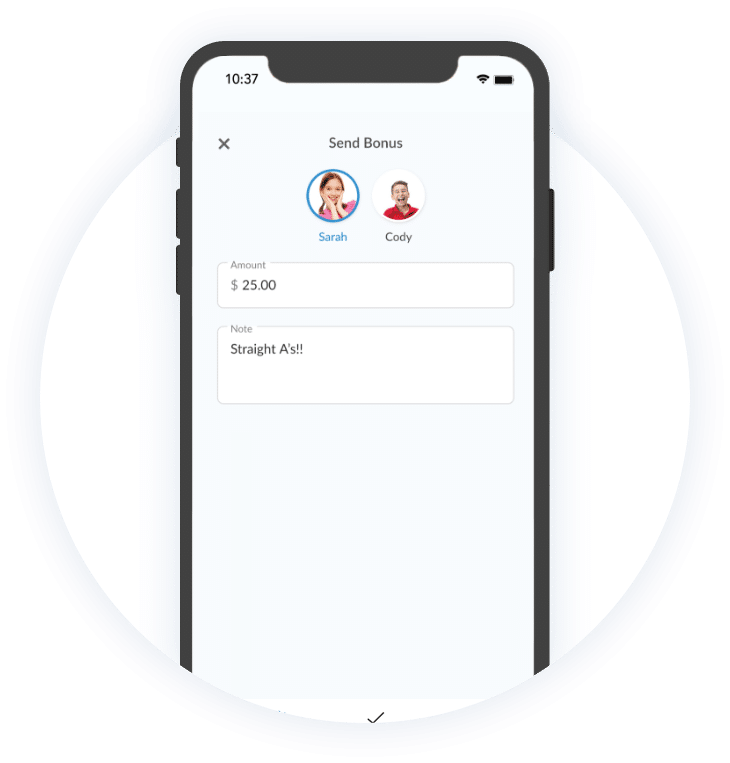

Bonuses

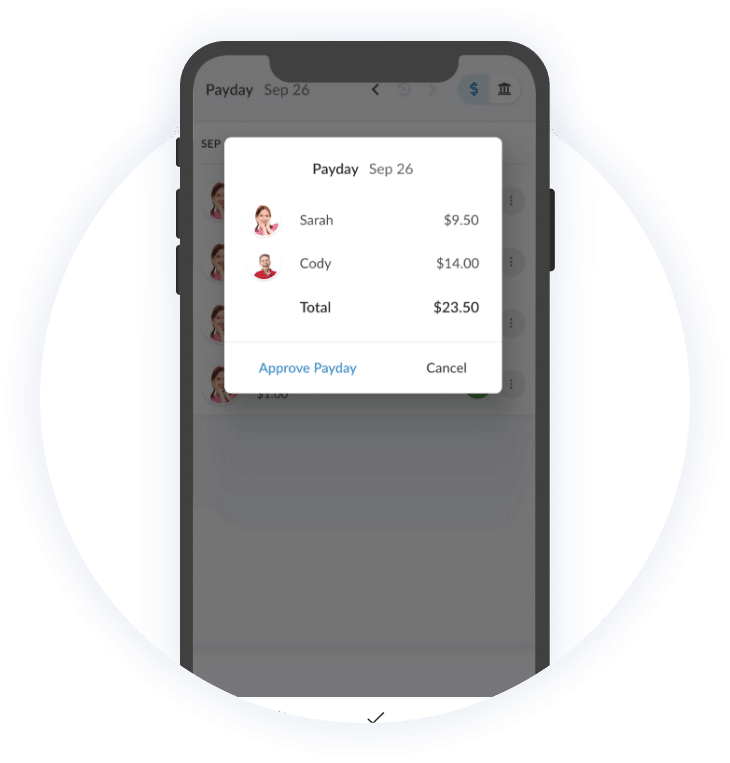

Parent Approvals

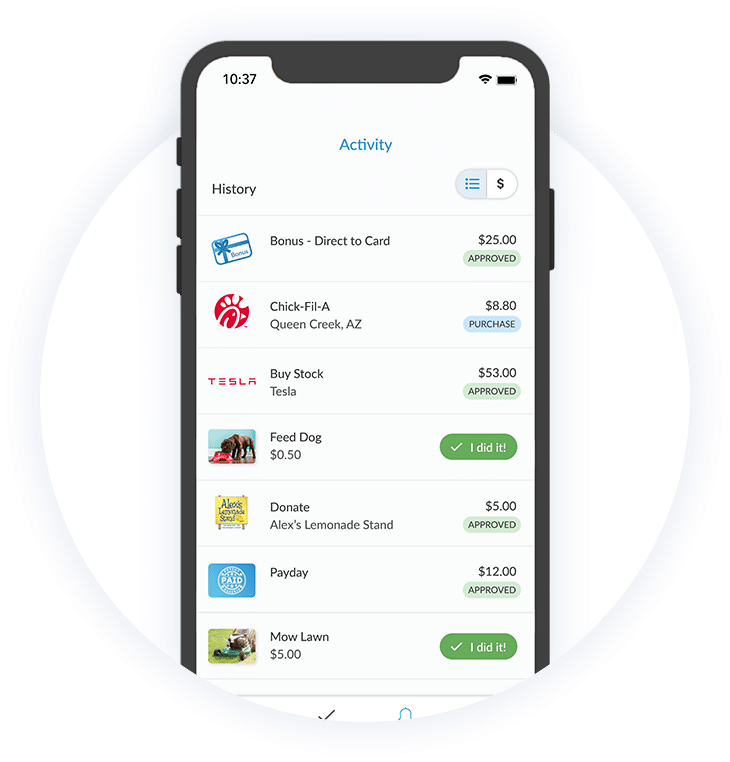

It’s History

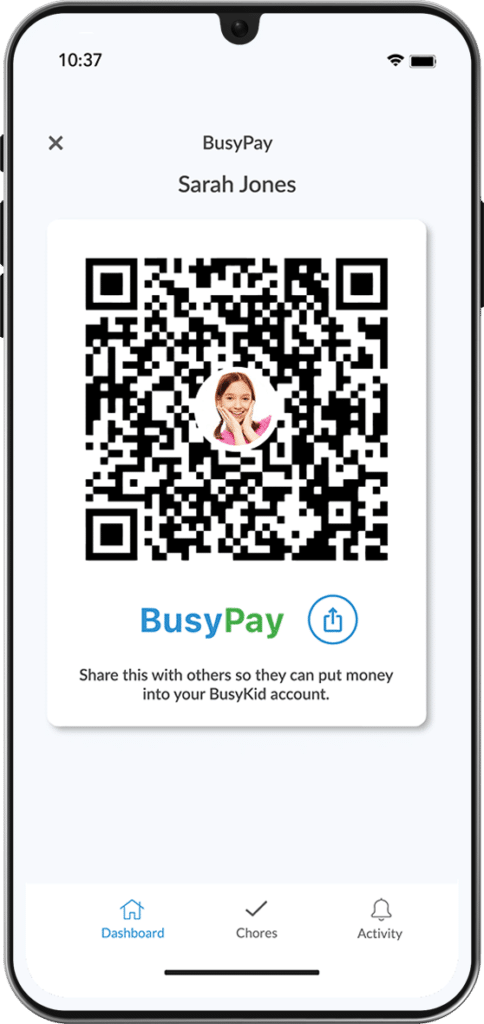

Send Money Using BusyPay™

BusyPay™ is an easy way for family or friends to instantly send money to a child’s BusyKid account.

Perfect for...

Birthdays

Spoiling

Grandkids

Holidays

Work

Babysitting

Mowing The Grass

When someone sends money using BusyPay™, they are promoting a balanced financial approach!

Save - Invest

Share

Get Started in Minutes...

We Think You'll Love It!

Subscribe to BusyKid today and soon after you’ll begin to see changes in how your kids think about and use money. They will also feel motivated to grow their balances, explore out app features and help make your life easier at home.

Plus, get all of these features too:

Parental Matching On Child Savings

Ability To Change Scheduled Paydays

Pay Allowance With No Chores

Parental Money Movement Controls

Establish Individual Identities

Multi-parental Approvals

Pre-set Chores/ Allowances By Age

Parental Activity Monitoring

Automatic Allowance Allocations

Safety, Savings, Support:

Pinwheel x BusyKid

Embark on a secure tech journey with Pinwheel, guided by you and enriched with vetted apps. Enjoy an exclusive 15% off at checkout with code BusyKid15 ensuring both safety and savings.

Explore our partnership – where your child’s well-being meets financial benefits for you!

Help & Support

COPYRIGHT © 2024 BusyKid®

* BusyKid Debit Card is issued by MVB Bank, Inc, pursuant to a license from Visa® USA Inc. Cliq® is registered ISO/MSP of MVB Bank, Inc.

For more information about your card terms and conditions including the VISA Zero Liability policy go here. Cliq® is registered ISO/MSP of MVB Bank, Inc.

Brokerage services provided by Apex Clearing, an SEC-registered broker-dealer and member of FINRA /SIPC.

Investments in securities: No Bank Guarantee • May Lose Value. Investing in securities involves risks, and there is always the potential of losing money when you invest in securities. Before investing, consider your investment objectives, charges and expenses. For more details, see our Form CRS, Broker Check and other disclosures.

*BusyKid can not refund any stock purchases made. There is no transaction fee when a bank account is used