Teaching Taxes to Your Children and How Much Money They Have to Make to File Taxes

There are numerous methods for teaching children about taxes. Pedagogues believe that children learn best through practice or learning while doing. That includes teaching children money management through gameplay or reward systems.

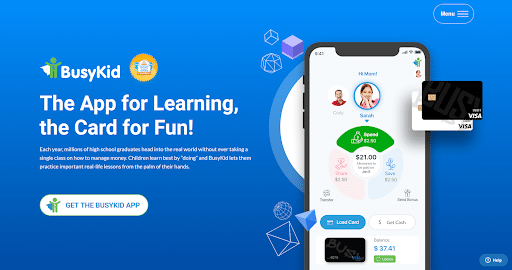

Another option is to use modern technology, such as the learning app BusyKid. A BusyKid app is an excellent tool for assisting your children in gaining valuable experience with money management. Parents can use it with children to teach them the fundamentals of financial literacy and how it affects their daily lives. After all, we live in a digital world, and the future will bring us more technology.

Teaching Taxes and Money Management to Your Kids in a Meaningful Way

Taxes are an inevitable part of life. They teach kids about spending and how to budget. However, the best way for children to learn is by explaining the concept of taxes to children on a fundamental level and helping them understand why they have to pay it.

Teaching taxes and money management to your kids can be complex if your working hours are hectic or you don’t know where to start with your child’s age group. Still, many resources available online will help you out in this process.

The simplest way to teach taxes to a child is by defining them as money that we pay to the government every year for them to provide us with services. But, of course, the younger they are, the simpler the explanation should be.

Have a conversation with your child about what they believe the government is responsible for doing. Is it taking care of roads, schools, garbage disposal, or fire protection? Most people would say yes. Now ask your child what they think the government does for themselves? Could it be paying for police officers to protect them from criminals? Would the government be able to buy food and water if they didn’t collect taxes?

The government needs money to do everything they do, so they collect taxes. They use this money to pay for the things that are important to people. The government still needs more money, so they need citizens like us to help them out. The conversation would now be about how much taxes people pay.

There are many ways that parents are teaching taxes to their children. One way is by using the tax code as a story and guiding it through games, like hide-and-seek or treasure hunts. Another way is by making a tax chart, which helps children understand how much they need to save for certain things in life like college or retirement.

- The first step in teaching taxes is ensuring they understand the basics. This includes understanding what tariffs are, how they work, and why they are essential. You can give examples from life to demonstrate the importance of managing money.

- The second step is to teach them the importance of saving money for retirement and college and, for example, giving them an allowance for a specific period.

- The third step is teaching them the importance of being financially responsible. You can do this by giving them a weekly allowance, explaining how to use it, and maintaining a sum by the end of the week.

- The fourth step is to teach them about the value of money and what will happen if they spend too much or save too little.

- The fifth step is to teach them how to file their taxes. You can do this by having them fill out a tax form or do a mock tax return.

The Ideal Age for Teaching Taxes and Money Management

Teaching taxes to children is not an easy job, as many adults still do not understand the concept entirely. However, as a parent, it is best to teach them, so they do not get surprised when they move out and start living independently.

The ideal age for teaching taxes and money management is from the age of 6 to 16. Most children in this age group are old enough to understand the concept of earning money but also young enough to be still interested in learning more about it.

The process of teaching taxes to kids should start with explaining the concept of managing money. Children look up to their parents and mimic what they do. It begins with making a coin-collecting hobby for your six-year-old. You can also take them to a grocery store and explain the difference between price tags.

Later on, you can introduce the concept of comparison and budget decisions. For example, you are bringing the budgeting down to their world. Their world revolves around small necessities such as clothing, school supplies, or lunch money. Setting a budget for the entire week and explaining the concept between “want” and “need.” We need some things in life to survive, while the things we want are unnecessary and can wait.

As the child progresses through the concept, the final step between the ages of 13 and 16 is teaching them how and why they need to pay taxes and what they can do with the money they earn. It should also involve them in decision-making processes like determining a budget.

You can, for example, explain that a single person filing for taxes must have an income of at least $12,950. What does that mean, and what are the things they should take into consideration. Explain the idea by saving money for a set length of time. Naturally, it does not mean you have to compel them to assist you in completing your tax. Instead, you start by utilizing the basics through your own experience.

For instance, they are buying clothes on a prom night. Next, collect the percentage of “taxes” from their allowance and the money they earned from chores. After they are ready to pay this amount, return it as a tax refund.

Teaching taxes does not have to be a dull session that your child will ignore, but an interactive and pragmatic lesson that will prepare them for life. Teaching your kids about earning money will help them develop better financial habits and prepare them for their future life when they become adults.

The Best Money Management Educational Software

BusyKid app is a safe and secure way for kids to learn about money. It is a mobile app for kids to learn about money. It teaches them about money management, including earning, saving, and spending.

The app provides valuable lessons in financial literacy through their own experience. It also provides an interactive interface that teaches money management in the real world.

BusyKid app provides a chore chart that’s tailored to each of your children. Each child is given chores and an allowance for each completed task. By the end of a specific time, the parent approves the release of funds. In addition, parents have the option to customize the bonus allowance for rewarding any good behavior or achievement.

BusyKid is a way for your children to make a difference by donating a percentage of their allowance to causes they care about. The app is created for parents who want to teach their children about philanthropy and teach them how to give back.

The BusyKid app is intended to prepare your child for the future and raise children who understand money management and how to save and spend in a conscious and non-materialistic manner. Because of its unique educational element, BusyKid has been featured on NBC, CBS, WGN, KTLA, and more!