Plenty of influences in our daily lives—including family, friends, coworkers, and celebrities—show us the value of a dollar. However, it’s our parents’ financial habits that are the biggest influence on how we spend our money.

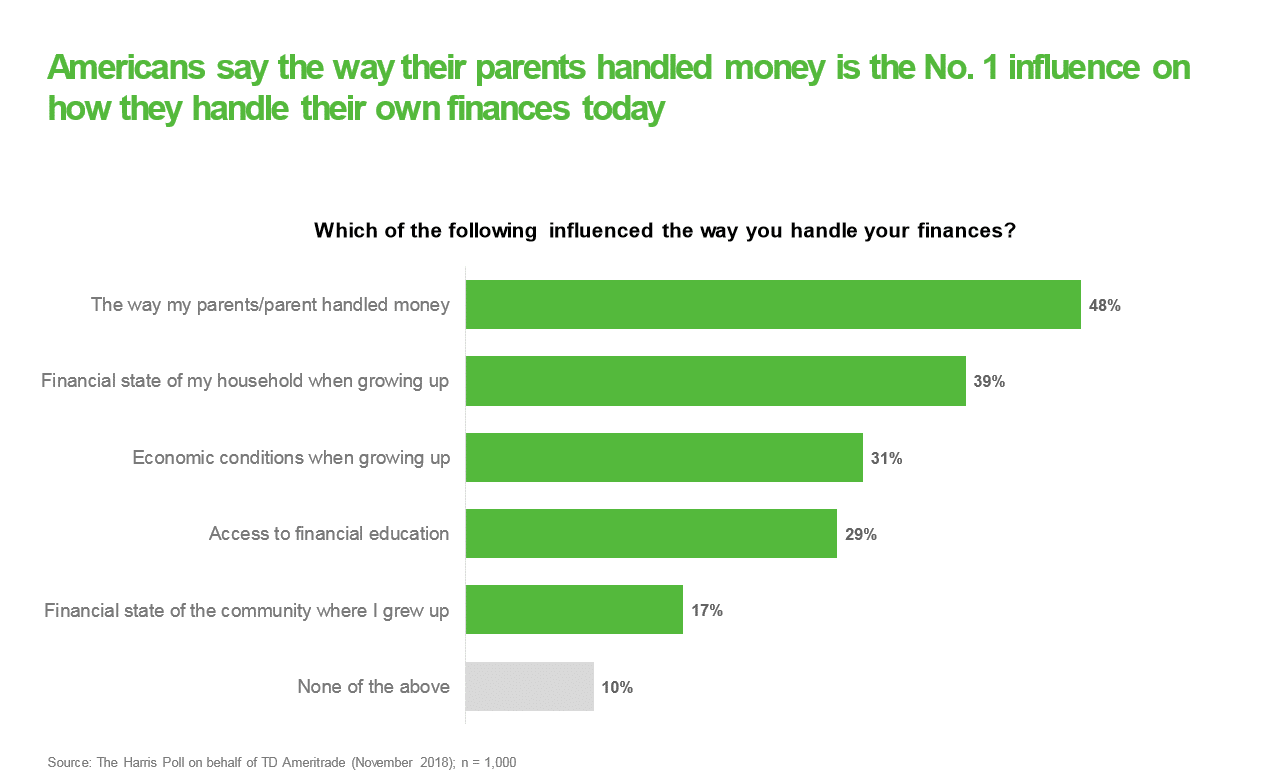

Almost half of Americans cited the way their parents handled money as an influence on how they handle their own finances, and 39% called out the financial state of their household while growing up, according to a new report from TD Ameritrade. The financial institution polled 1,000 U.S. adults aged 22 and older, who have at least $10,000 in investable assets.

“Financial education was so far down the list,” says Chris Bohlsen, director of investor service at TD Ameritrade. “Less than a third of those who responded mentioned access to financial education as being the main influence.”

That’s not surprising. Only 17 states require high school students to take a personal finance class—so most of us learn about money in less formal ways.

Your kids are paying attention to everything you do, says Bohlsen. “Whether parents have strong spending habits or not-great spending habits, that’s going to have some influence on us,” he says.

If you’re a parent, no pressure. Here are two easy strategies to make sure you’re passing along the right money lessons to your kids.

Use cash

Credit cards. E-banking. Digital wallets. One downfall of the trend to cashless payments is that kids don’t have as much exposure to transactions with bills and coins, says Marcy Keckler, vice president of financial advice strategy at Ameriprise Financial.

“We know cash is not part of people’s daily life,” says Keckler. “Parents may want to bring some cash into the picture to help kids make that tangible connection.”

More from Grow:

Offer experience

Keckler advocates for allowances to help kids learn the connection between work and money. She says letting kids make their own financial decisions—and mistakes—is key. For example, not intervening before they spend their saved-up allowance money on something that turns out to be low quality.

“[This lets] kids learn the lesson when the stakes are pretty low, so they don’t have to learn it at a later stage,” she says.

Talk about money

“Money today is literally little numbers on a screen,” says Gregg Murset, CEO of childhood fintech tool BusyKid. “One thing I think parents can do to help with those money habits is be a little more transparent with what’s going on.”

Include kids in the conversation as you tackle daily money tasks. For example, spend your trip to the supermarket talking about how you budget, or discuss paying bills when you sit down to pay them.

“Parents really just need to get a system and be kind of consistent with it,” he says. “You don’t have to be perfect at this.”

Check out An HSA is a great way to manage health-care costs via Invest in You with CNBC + Acorns.