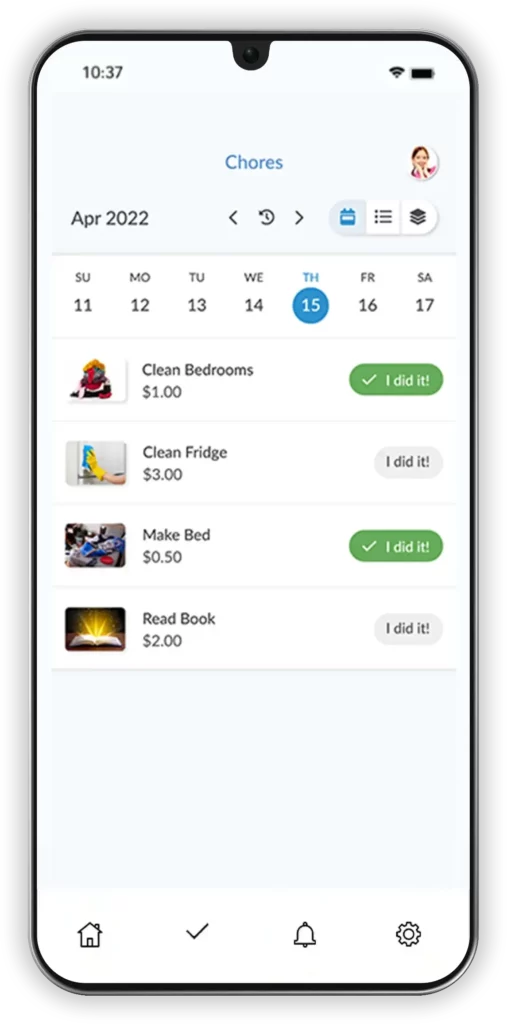

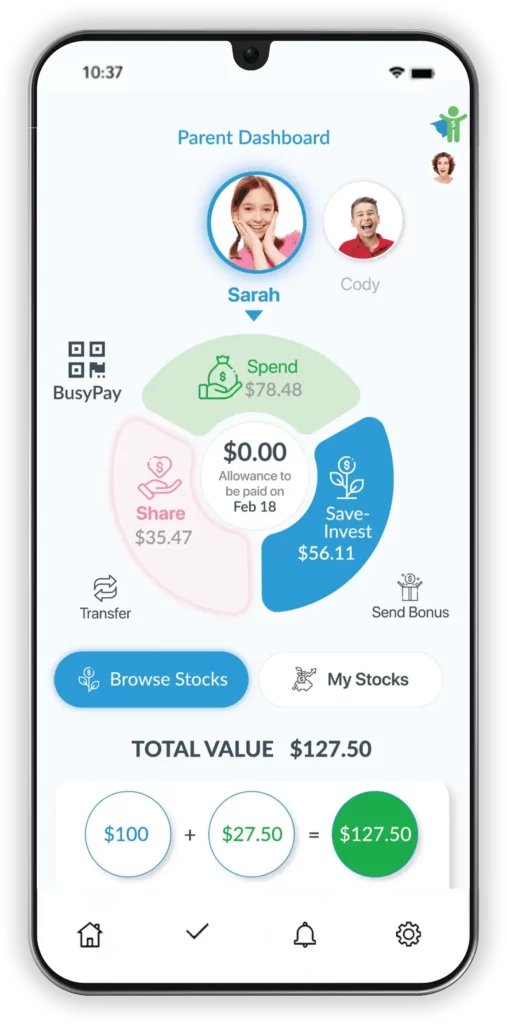

It’s time for our children to learn how to manage money from an early age and BusyKid helps them do so right from the palm of their hands. They even get their own Visa debit card to have some fun along the way.

BEST APP FOR KIDS TO LEARN MONEY MANAGEMENT!

Broken down to $4/mo. (billed annually), your entire family can have access to investing, donations, and up to five BusyKid debit cards.

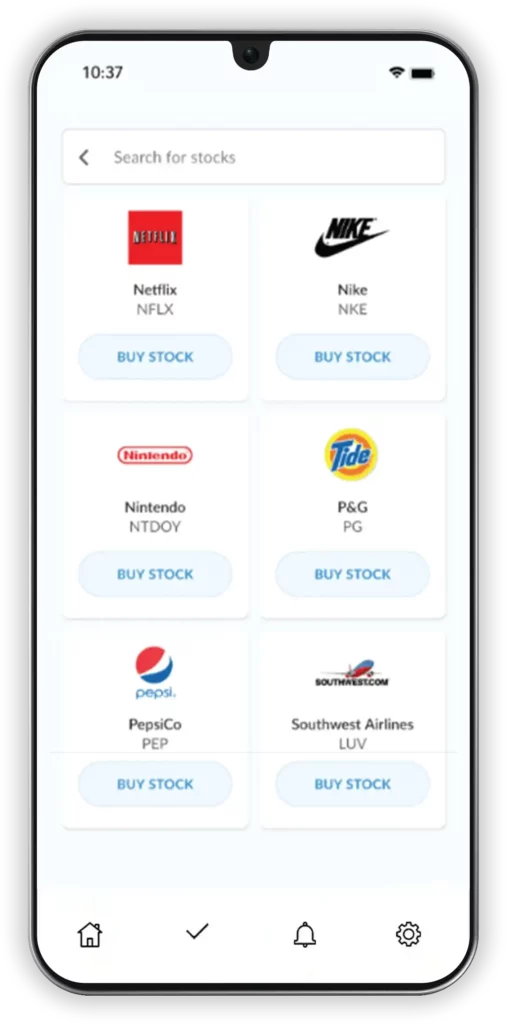

Any companies shown are not recommendations or solicitations to invest.

BusyKid Is Designed to Be

Easy to Use!

It Couldn’t Be More

Simple!

Earn

It Couldn’t Be More

Simple!

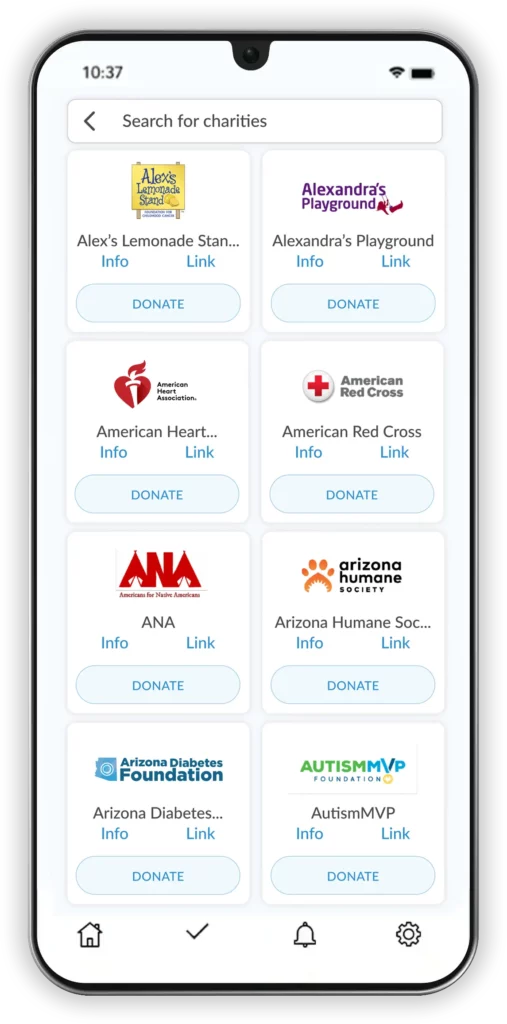

Donate

It Couldn’t Be More

Simple!

Save

It Couldn’t Be More

Simple!

Invest

Any companies shown are not recommendations or solicitations to invest.

The BusyKid Visa® Kids Debit Card gives your kids the freedom to spend anywhere Visa is accepted, and parents see every transaction made. Transfer funds anytime and anywhere.

Broken down to $4/mo. (billed annually), your family can have complete access to our award-winning app and up to 5 BusyKid Debit Cards. Never a need to upgrade!

So this is a perfect time to teach your children how to spend responsibly.

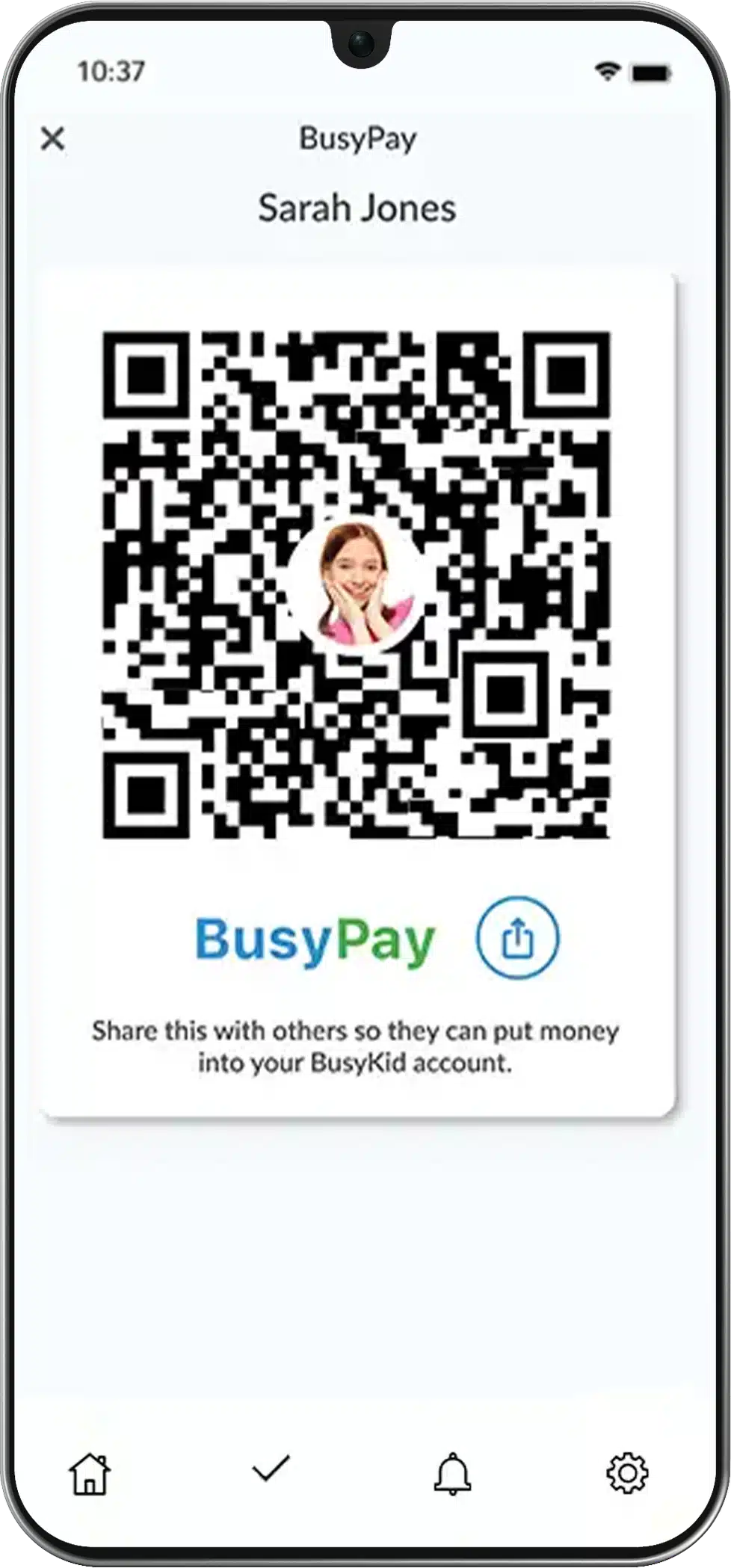

BusyPay™

Here’s What

Parents Are Saying About Us

A testimonial may not be representative of the experience of other customers.

A testimonial is no guarantee of future performance or success.

Subscribe to BusyKid today and soon after you’ll begin to see changes in how your kids think about and use money. They will also feel motivated to grow their balances, explore out app features and help make your life easier at home.

Help & Support

COPYRIGHT © 2024 BusyKid®

* BusyKid Debit Card is issued by MVB Bank, Inc, pursuant to a license from Visa® USA Inc. Cliq® is registered ISO/MSP of MVB Bank, Inc.

For more information about your card terms and conditions including the VISA Zero Liability policy go here. Cliq® is registered ISO/MSP of MVB Bank, Inc.

Brokerage services provided by Apex Clearing, an SEC-registered broker-dealer and member of FINRA /SIPC.

Investments in securities: No Bank Guarantee • May Lose Value. Investing in securities involves risks, and there is always the potential of losing money when you invest in securities. Before investing, consider your investment objectives, charges and expenses. For more details, see our Form CRS, Broker Check and other disclosures.

*BusyKid can not refund any stock purchases made. There is no transaction fee when a bank account is used