BusyKid is excited about its exclusive partnership with MoneyTime to provide an online financial literacy program for kids.

MoneyTime is where kids learn how to earn and manage money through lessons, quizzes and a money management game.

It’s the perfect place to learn personal finance before using BusyKid to benefit from what was learned.

Through this partnership families can access MoneyTime’s special offer.

Helping to Improve

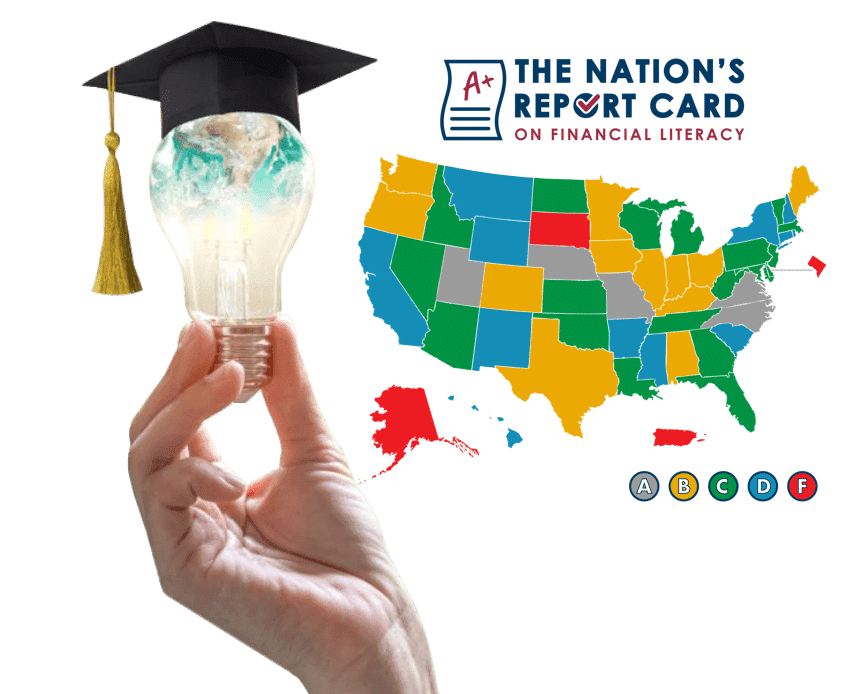

Financial Literacy Across America

In working towards our goal of using modern technology to develop strong character, work ethic and money management skills in the next generation of children, BusyKid is proud to join forces with the American Public Education Foundation (APEF). Our organizations will shine a light on what is really being taught in schools and advocate for their improvement and development.

Did you know only 48% of Americans are able to pass a financial literacy test or survey? Based on requirements, standards and curriculum, each state was graded on its K-12 financial education. 33 out of 50 states earned a C, D or F grade.

Assets are items you own that can provide future benefit to your business, such as cash, inventory, real estate, office equipment, or accounts receivable, which are payments due to a company by its customers. There are different types of assets, including:

A charity is an organization that collects donations for a cause. In the BusyKid app SHARE section, you can donate a percentage of your allowance to a select number of charities.

Fun fact: charities usually have different tax structures than for profit companies.

Credit lets you buy something without having to pay for it right away. It’s NOT FREE MONEY, but if you use a credit card to buy a toy, the credit cards company is buying the toy for you. Then they send you a bill and you have to pay them back the $200. If you don't pay them back right away, they will charge you interest. The longer it takes you to pay back, the more money you will owe in the end. While credit cards are necessary to have, especially for travel, they are easy to over use and create large sums of debt.

A credit score is given by three credit bureaus - Experian, Equifax and TransUnion. These calculate your “credit score” based upon how you use your money. The goal is to have a high credit score, and the to do this is to have a long history of paying your bills on time. When you don't pay your bills on time or you have too much debt, your score gets lowered.

It’s important to know that a good credit score will help in the future if you want to borrow money to buy a house or a car. Meanwhile, a bad credit score can make it difficult for you to borrow money.

Money owed, usually as a result of borrowing. If someone borrows $18,000 to buy a new car, they are known to have $18,000 in debt. There are two main kinds of debt:

National Debt: The amount of money a country owes. The U.S. national debt is roughly $31 trillion at the beginning of 2023. Basically this means that every person in the U.S. owes over $94,000.

Personal Debt: The amount of money an individual person owes.

A debit card is different from a credit card since it takes money directly from your checking account. Debit cards have replaced checks as the standard form of payment in most situations. Debit cards are a convenient way to use the money in your checking account, but the risk to overspend is higher because of the use of use and 'invisibility' of the money.

A deposit takes place when money is added to an account. Deposits can be made into checking, savings or investment accounts. When you complete your weekly chores, you receive a deposit into your BusyKid account. This is also sometimes referred to as a direct deposit.

A dividend is money that a company pays out to shareholders from corporate profits. Dividends can be paid out in different ways- most often in cash or as shares of stock.

Some companies pay dividends but others do not. The decision to pay dividends often depends on where a company is in its life cycle- a well established company may decide to pay dividends, while a newer company may reinvest the money into new projects that will grow the business.

Companies that HAVE historically paid dividends include: Exxon Mobile, Apple, Microsoft, Wells Fargo and Verizon.

Companies that HAVE NOT historically paid dividends include: Facebook, Tesla, Alphabet, Biogen and Amazon.

An indicator of how the stock market is performing. It is based on the stocks of 30 well-known companies, including General Motors, McDonalds, Microsoft, and Disney. When the value of these stocks goes up, the "Dow" goes up, too. The Dow Jones Industrial Average goes up or down every day.

The FDIC is the government agency that insures bank deposits. Let's say a bank has 100 customers who each deposit $3,000. The bank is allowed to use a percentage of those deposits to make loans and conduct everyday business. But if all 100 customers want to withdraw all of their money at once, the bank must be able to produce the cash. What happens if the bank does not have enough money on hand to do that? If the bank is insured by the FDIC, it will step in and make sure the customers get their money. In order to be insured by the FDIC, a bank must show that it is operating fairly and obeying all banking laws. Right now, the FDIC insures every bank depositor for up to $250,000.

A process in which homeowners lose their home because they have failed to make mortgage payments. Homeowners often borrow money from a bank to pay for their new home. They are expected to repay part of that money each month. If they fail to make the monthly payment, they might first receive a warning from the bank. If they miss many payments and have not worked out an agreement with the bank, the house might go into foreclosure. That means it becomes the property of the bank, and they will be forced to find another place to live.

Interest is money that is paid regularly for the use of money. Interest can be paid or interest can be earned. Interest is paid to a bank when money is borrowed to buy a house. Interest is earned when your sister runs out of her allowance and you give her $20 and charge $2 for the use of your money. The more interest charged to the loan, the larger the overall amount of the loan upon repayment.

The percentage at which interest is charged or paid. For example, imagine that you borrow $100 at an annual interest rate of 4%. At the end of one year, you will owe $104. Sometimes interest is added on every day or every month, but it is basically calculated the same way.

Investments are when you put money into something with the expectation of not only getting your money’s worth but to also profit off of it. The two biggest investments you will be making are in Stocks and some savings accounts.

A loan is something that is borrowed, often money, which has to be paid back. If you’ve ever lent something to a friend or sibling and expected to get it back, that’s a loan. While taking out a loan isn’t a bad thing, it's your responsibility to pay it back.

The national debt is the amount of money the federal government has borrowed to cover the outstanding balance of expenses incurred over time. To see the current amount click here.

A drop in economic growth that lasts at least six months. During a recession, businesses sell fewer goods and services. Once a recession becomes severe (with total sales of goods and services down by more than 10% for a long period of time), a recession can be described as a depression.

Stocks: This is something that you will get to buy when you use this app. Stocks are tiny pieces of a business whose value either goes up or down depending upon its performance.

Stock Market: This is where you will buy and sell the stocks. You will go to the Stock Market to check the price and trends of stocks.

Stockholder: The name of someone who owns stock in a company. If you were to use your allowance to buy stock, you will then become a Stockholder.

When you become an adult and start working, you have to give part of your pay to taxes. This money helps pay for things run by the Government like roads, the military, and National Parks. There are different levels of taxes that you’d have to pay like Federal Taxes, State Taxes, and Property Taxes.

The unemployment rate is the percentage of Americans who are out of work and looking for jobs. High unemployment rates are a sign of a weak economy. Through January 2019, the National Unemployment Rate was 4.0%. That means just 4 out of every 100 workers needed jobs. During the Great Depression of 1929, the unemployment rate reached almost 25%.

This is what it is called when you take money out of your checking or savings account. You withdraw the money from your account.

Subscribe to BusyKid today and soon after you’ll begin to see changes in how your kids think about and use money. They will also feel motivated to grow their balances, explore out app features and help make your life easier at home.

Help & Support

COPYRIGHT © 2024 BusyKid®

* BusyKid Debit Card is issued by MVB Bank, Inc, pursuant to a license from Visa® USA Inc. Cliq® is registered ISO/MSP of MVB Bank, Inc.

For more information about your card terms and conditions including the VISA Zero Liability policy go here. Cliq® is registered ISO/MSP of MVB Bank, Inc.

Brokerage services provided by Apex Clearing, an SEC-registered broker-dealer and member of FINRA /SIPC.

Investments in securities: No Bank Guarantee • May Lose Value. Investing in securities involves risks, and there is always the potential of losing money when you invest in securities. Before investing, consider your investment objectives, charges and expenses. For more details, see our Form CRS, Broker Check and other disclosures.

*BusyKid can not refund any stock purchases made. There is no transaction fee when a bank account is used